It set up a factory in Perlis to manufacture seamless steel pipes. What is the difference between Pioneer Status and Investment Tax Allowance.

Pioneer Status Salient points.

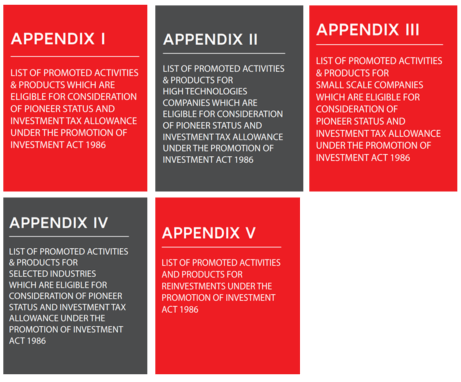

. Promoted Products or Activities. Approval of pioneer status to a company to be located. Promoted Products or Activities.

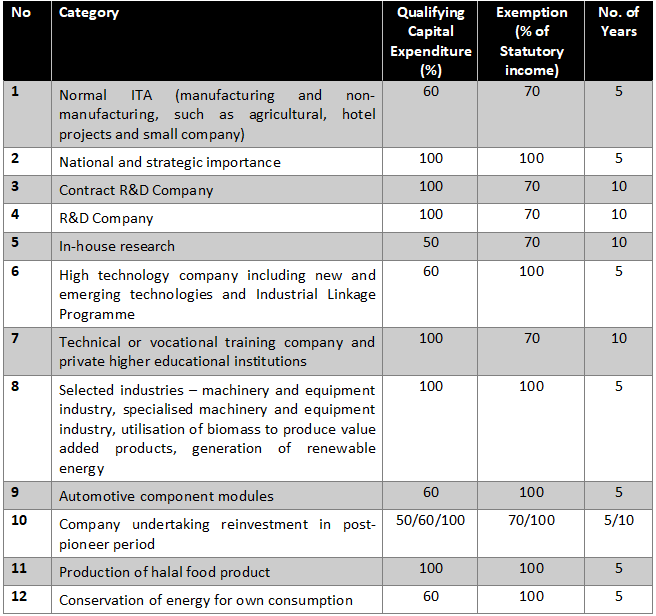

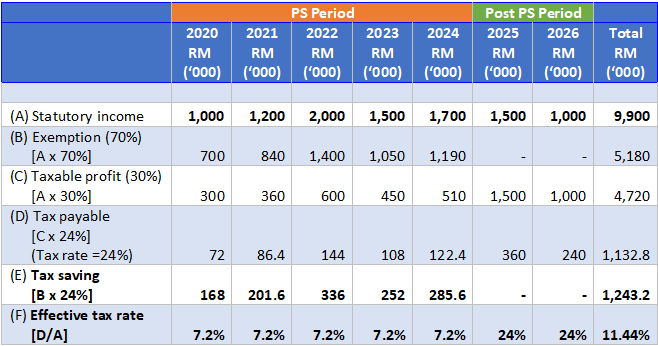

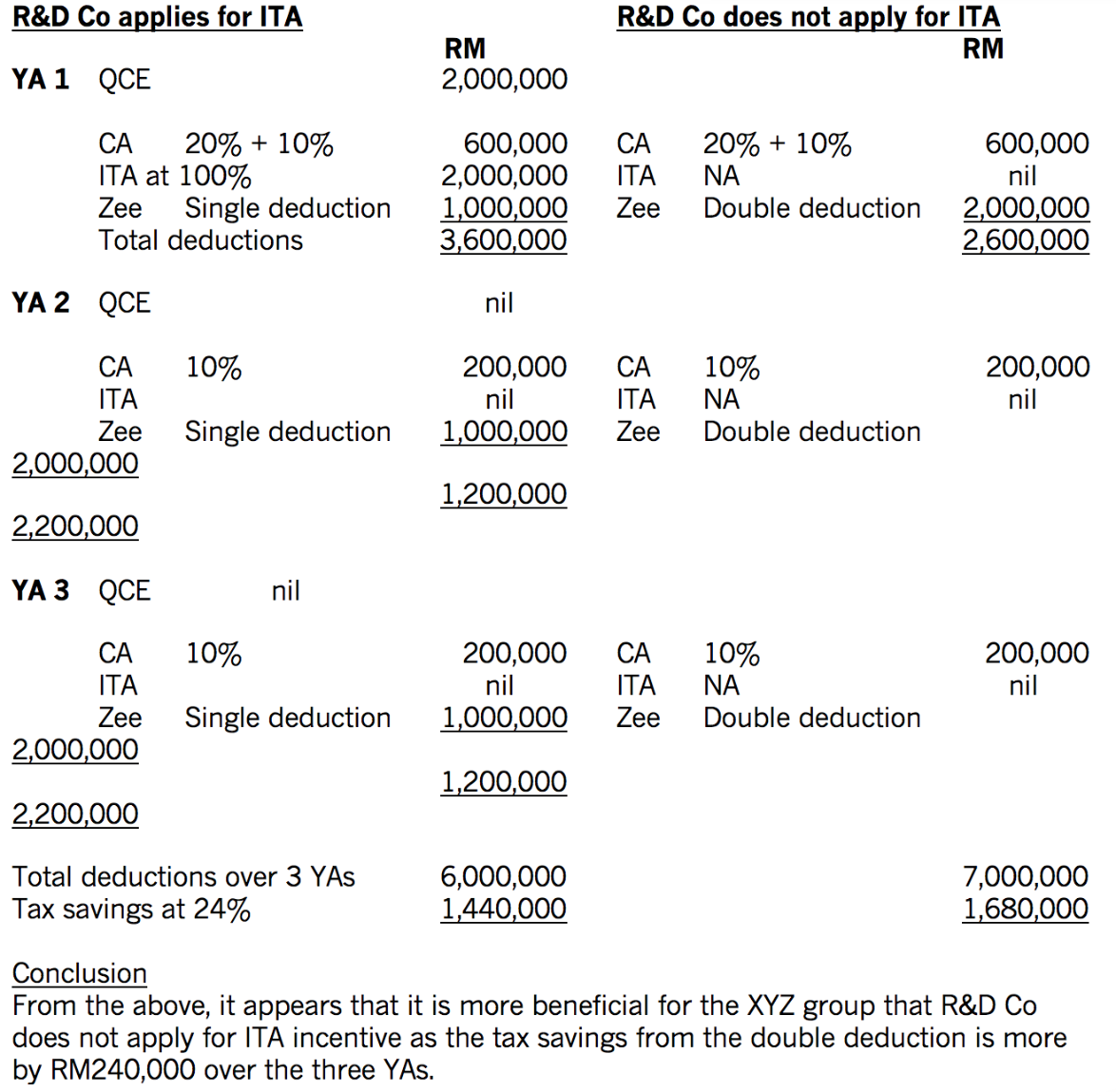

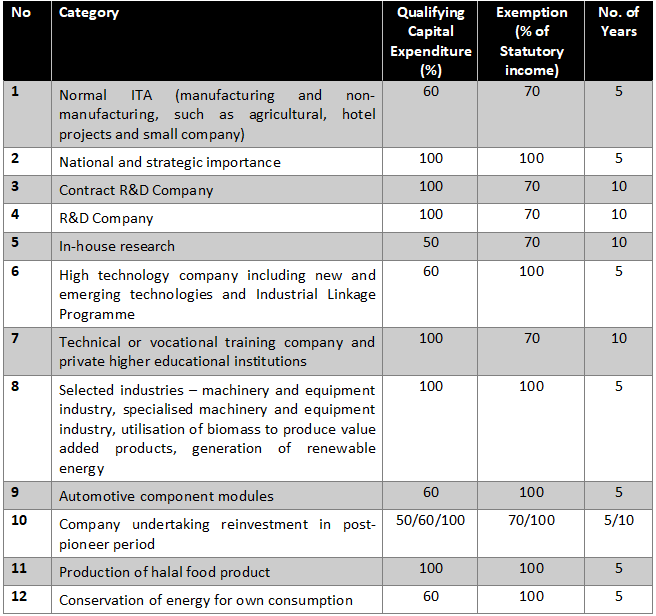

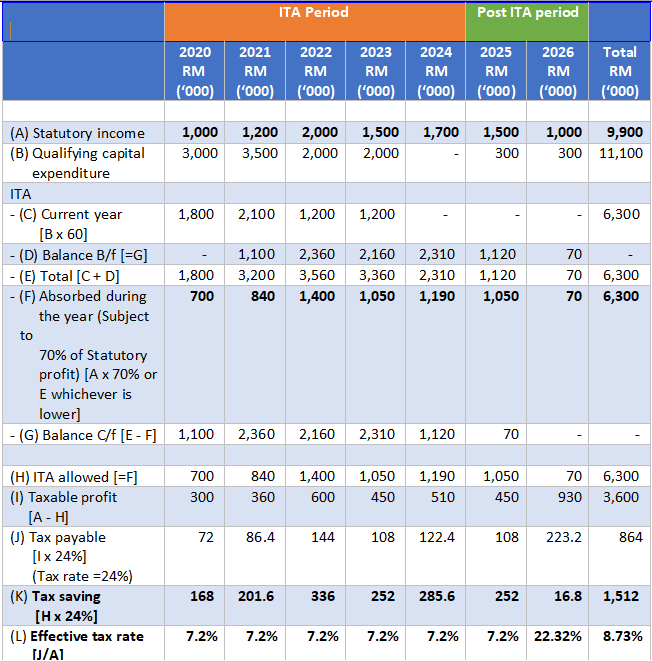

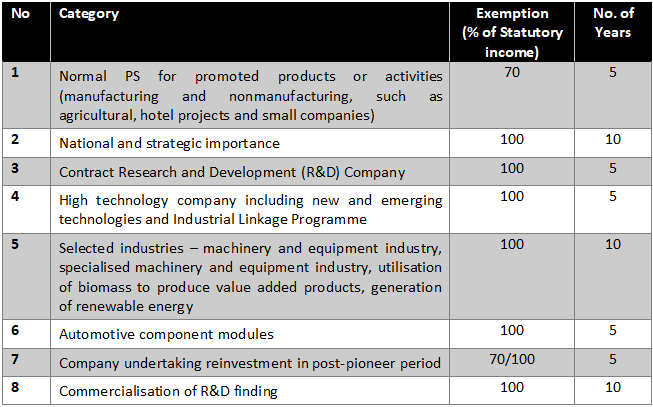

Main Incentives for Manufacturing Companies. Tax exemption restricted to 70 of statutory income for 5 years. The company applied for Investment Tax Allowance on November 15 2013 and this was approved by the.

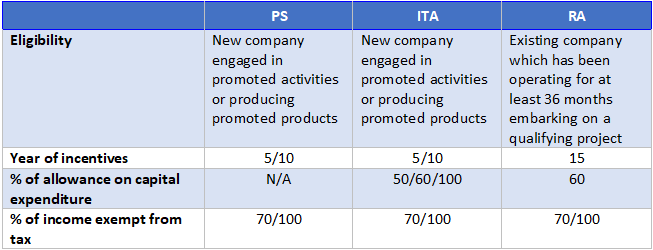

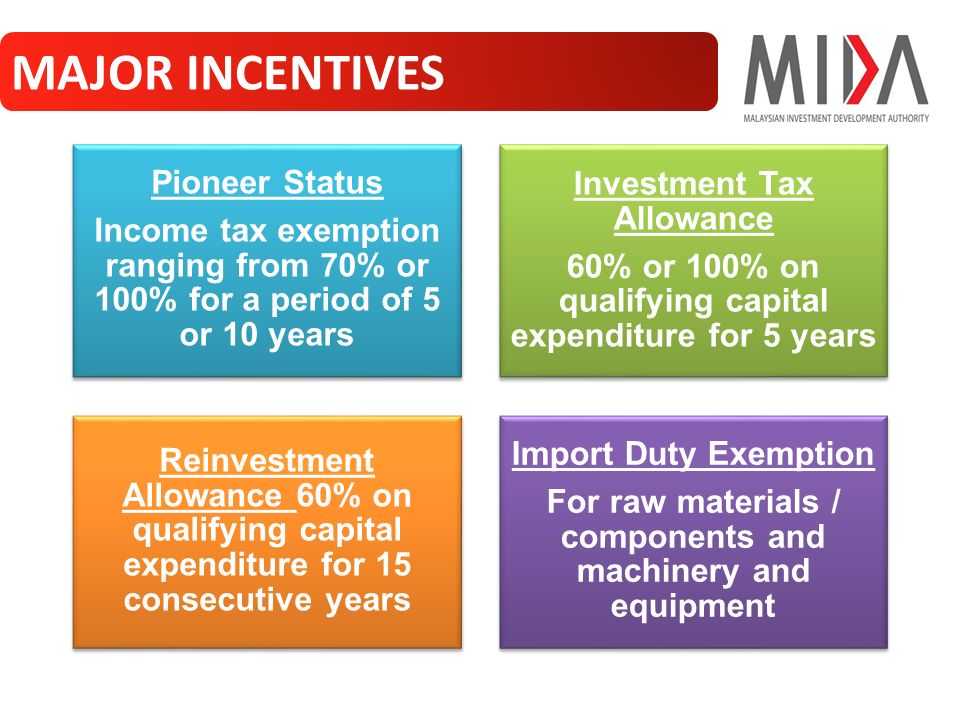

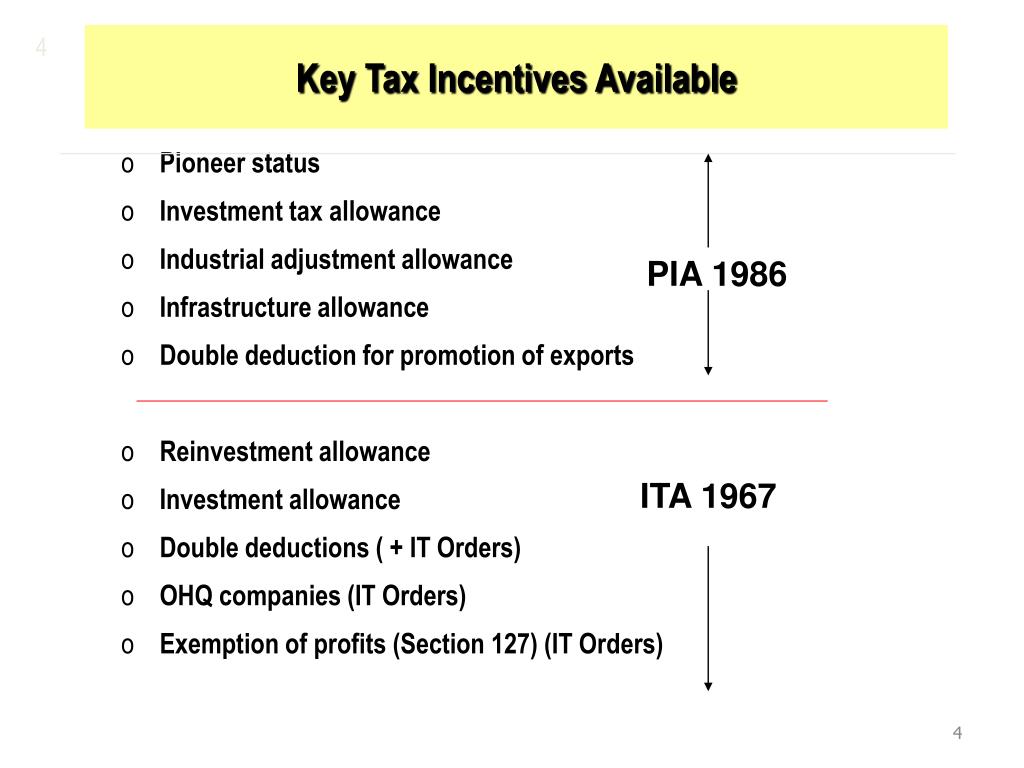

The salient features of these incentives are discussed below. Pioneer Status PS The standard PS incentive is a partial exemption from the payment of income tax for a period of 5 years up to 70. Similar lists of promoted products or activities as applied for pioneer status would also be applied for.

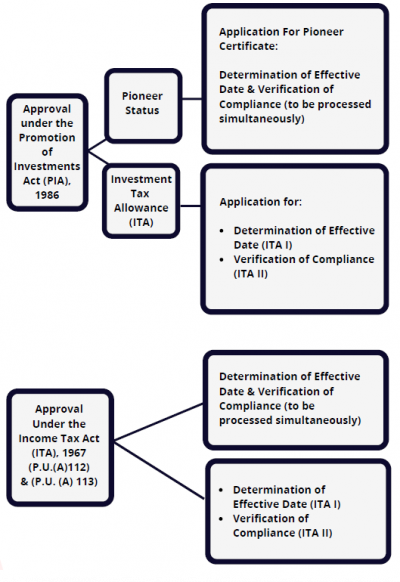

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Minister a company granted pioneer status or issued with a pioneer certificate may surrender its pioneer status retrospectively so as to enjoy Although the Promotion of Investments Act 1986 covers more than one tax incentive only two pioneer status and investment tax allowance ITA are examinable in Paper P6 MYS. For projects with longer gestation period and high capital.

Uses a design formula scheme method process or system. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5. INTRODUCTION Tax exemption on statutory income.

Pioneer status is granted for an initial period of 5 years commencing from the production day as determined by the Ministry of International Trade and Industry MITI. Generally tax incentives are available for tax resident companies. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia.

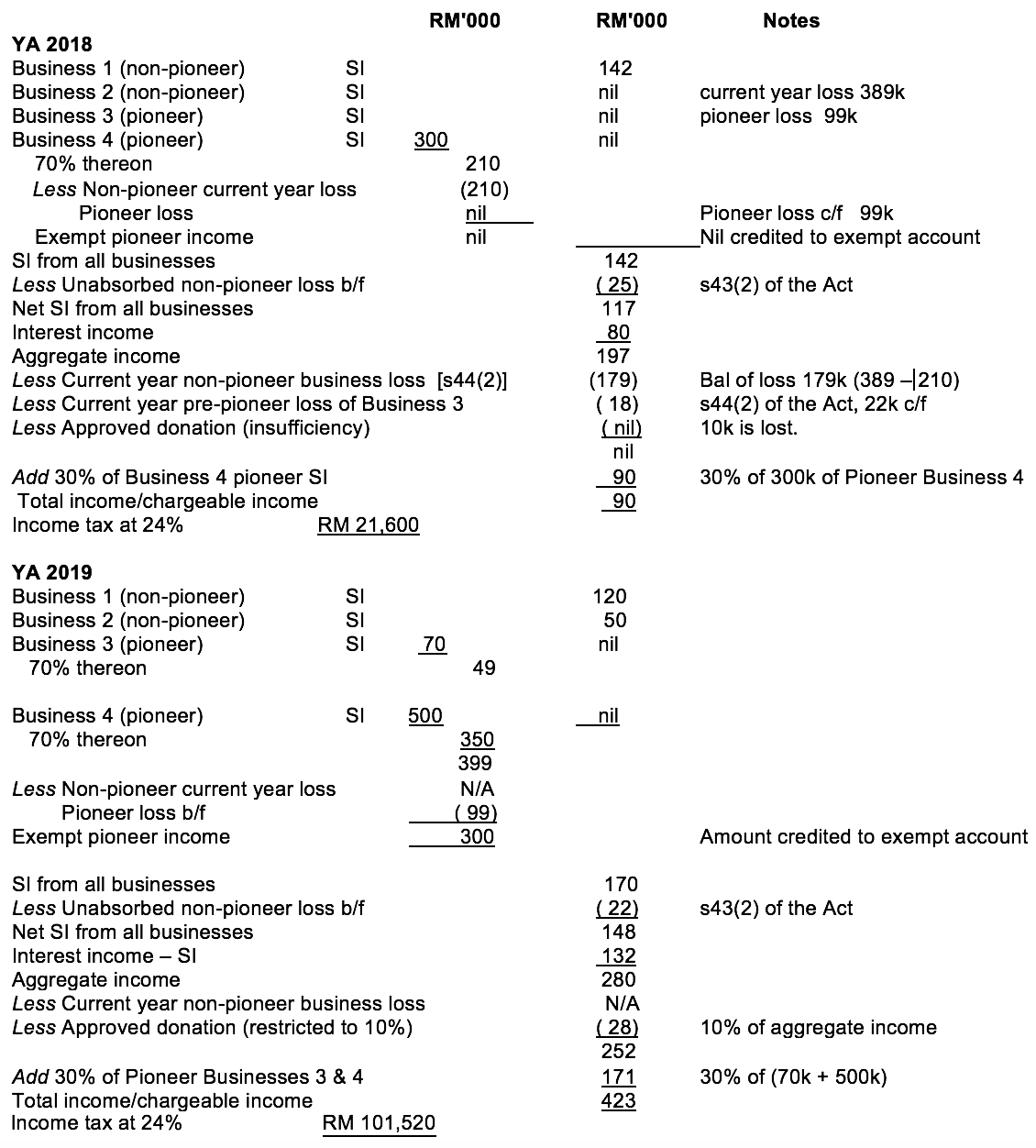

Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. Unabsorbed losses not to be carried forward to post-pioneer period. General Like PS ITA is an incentive measure available only for promoted products or promoted activities.

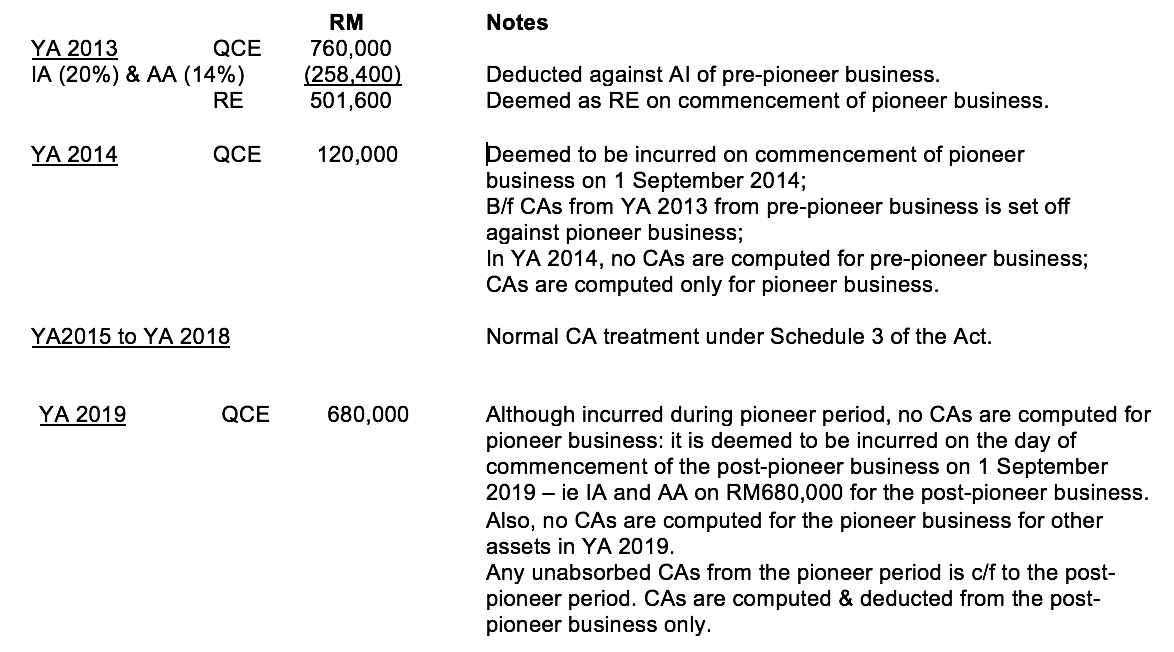

Any company participating or intending to participate in a promoted activity or producing a promoted product may be eligible to apply for ITA. Unabsorbed capital allowances not to be carried forward to post-pioneer period. Adjusted business income from a pioneer activity is fully exempted from tax.

Translations in context of ARE THE PIONEER STATUS AND THE INVESTMENT TAX ALLOWANCE in english-malay. Application for pioneer status received on or after 1111991. HERE are many translated example sentences containing ARE THE PIONEER STATUS AND THE INVESTMENT TAX ALLOWANCE - english-malay translations and search engine for english translations.

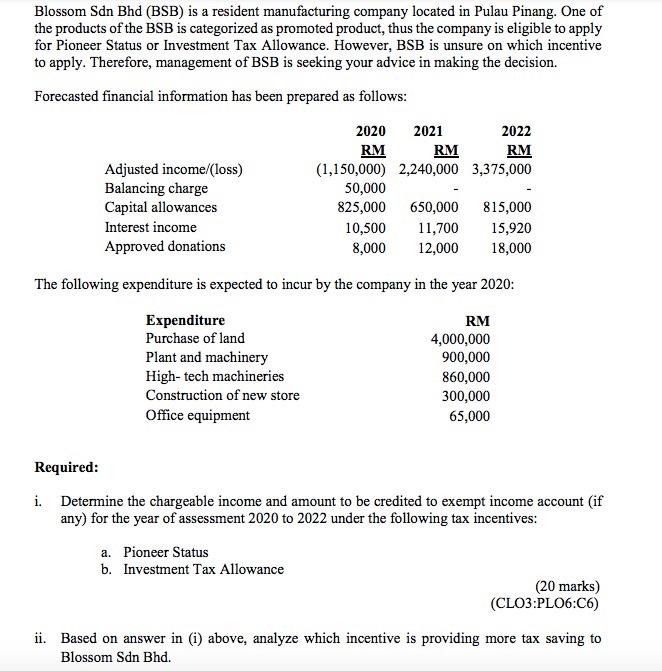

Compute the amount of unabsorbed pioneer business losses available to carry forward at the end of the tax relief period. ABC Sdn Bhd was incorporated in early 2013. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that generally provides for a deduction over and above capital allowances equivalent to 60 of the qualifying expenditure.

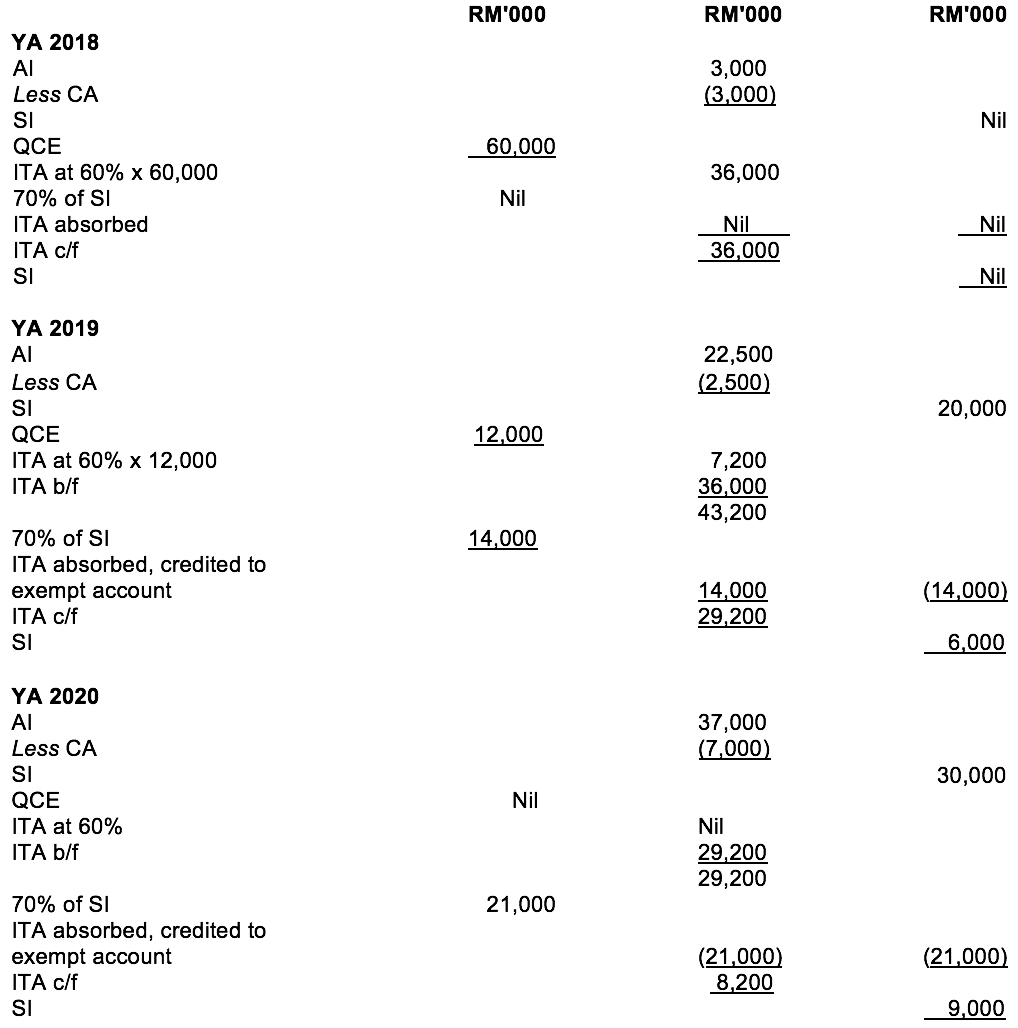

As an alternative to Pioneer Status a company may apply for Investment Tax Allowance ITA. Pioneer status PS and investment tax allowance ITA Companies in the manufacturing agricultural and hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either PS or ITA. Adjusted business income from a pioneer activity is tax-free on its whole.

A preferred area of investments may be declared Pioneer if the activity. Capital allowances are not deducted. Capital allowances are not deducted and on the first day of the post-pioneer period the qualifying expenditure is presumed to have been incurred.

Computation of tax charged click here. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5. Ii Differences between Pioneer Status and Investment Tax Allowance.

Involves the manufacturing or processing not merely assembly or packaging of goods or raw materials that have not been produced in the Philippines on a commercial scale. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. A company granted ITA is entitled to an allowance of 60 on its qualifying capital expenditure factory plant machinery or other equipment used for the approved project incurred within five years from the date the first qualifying capital expenditure.

Pioneer status is granted for an initial period of 5 years starting from the day of production. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. Eligible activities and products are.

A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 - 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 - 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. Eligibility for Pioneer Status and Investment Tax Allowance is based on certain priorities including the level of value-added technology used and industrial linkages. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that generally provides for a deduction over and above capital.

It is an alternative to PS but comes in the form of additional relief of 60 of the qualifying capital expenditure QCE incurred to be set-off against 70 of SI. 1222019 Pioneer status investment tax allowance and reinvestment allowance ACCA Global 1118 General RA is an incentive provided under the Act Schedule 7A to encourage reinvestment or continued investment by foreign and domestic investors hence the rather long 15-year TRP. The alternative to pioneer status incentive is usually the investment tax allowance ITA.

Promotions of Investments Act 1986 - Investment Tax Allowance. As these two incentives are mutually exclusive careful and proactive planning is essential to maximise the savings from a choice. The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. What is a Pioneer status. The tax incentives are provided in forms of exemption of profits allowance for capital expenditure or double deduction of expenses.

No extension of tax relief period for a further 5 years. In this article we will explain the main three types of tax incentives available for industries in Malaysia which are Pioneer Status PS and Investment Tax Allowance ITA which are available under Promotion of Investment Act 1986.

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives For Research And Development In Malaysia Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Www Mida Gov My Ica Ja Ik Ja Crd Amp Fp Guidelines And

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Business And Investment Opportunities In The Machinery Equipment Supporting Engineering And Medical Devices Sectors In Malaysia Ppt Download

Do You Run Or Own A Green Penang Green Council Facebook

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Solved Justify Why Tax Incentives Especially Pioneer Status Chegg Com

Promoted Activities Mida Malaysian Investment Development Authority

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Solved Blossom Sdn Bhd Bsb Is A Resident Manufacturing Chegg Com

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Getting To Know The Licensing And Incentive Compliance Monitoring Pppg Function Of Mida Mida Malaysian Investment Development Authority